Open Finance is a race. Tyk helps you win it.

Tyk gives financial institutions the control, security, and performance needed to run Open Finance at scale, while keeping the agility to adapt quickly as products, partners, and regulations evolve. Deploy fast, secure APIs with Tyk and integrate effortlessly with fintechs, aggregators, and partners while providing consistently great customer experiences.

Connect

Connect to the fintech ecosystem faster, integrating with BaaS providers, aggregators, and third-party services in days, not months.

Accelerate

Speed up lending decisions with real-time data sharing through secure, faster lending decision APIs, enabling rapid underwriting and better customer experiences.

Deliver

Deliver AI-powered experiences with well-structured APIs as the foundation for AI-driven lending decisions, fraud detection, and personalized banking.

Grow

Create new revenue streams, exposing banking-as-a-service capabilities to third-party partners and developers.

Built for the embedded finance era

Customers expect connected banking. Are your APIs ready?

Modern customers expect instant loan decisions, personalized financial advice, and flawless fintech app connectivity.

To win, you need an API strategy that powers innovation and customer delight with instant account aggregation, embedded finance, and seamless Open Banking experiences.

Leverage Tyk’s Open Banking API platform to:

Real-world, real-time impact

Discover why banks and fintechs choose Tyk

Institutions around the globe are powering their Open Finance use cases with Tyk, innovating and scaling securely as they delight customers with new products and new experiences.

Enhanced performance and scalability

Reduce latency and increase reliability.

Bank Central Asia (BCA) reduced latency for mobile banking transactions and achieved zero downtime while scaling to over 50 million daily API calls with Tyk.

Compliance through automation

Empower teams to move faster with confidence.

Financial services software company Paymenttools used Tyk to automate compliance and embed security. Its “invisible” governance is now supporting rapid scaling.

Cost savings through modernization

Escape legacy lock-in and redirect spend to innovation.

TAB Bank migrated from MuleSoft to Tyk, maintaining FAPI compliance while cutting 70% of API platform costs, freeing budget for AI initiatives and faster delivery cycles.

Move from compliance to competitive advantage

Overcome Open Banking’s regulatory challenges while accelerating the vast potential of Open Finance with Tyk. Transform your API infrastructure into a winning strategic differentiator.

Built for Open Finance standards

- FAPI 2.0 compliance ready

- PSD2, UK Open Banking API support

- OAuth 2.0, OpenID Connect, mTLS

- Dynamic Client Registration (DCR)

- Secure token handling with DPoP

Easy ecosystem connections

- Instant fintech partner onboarding

- Banking-as-a-service platform enablement

- Third-party provider (TPP) management

- Account aggregator connectivity

- Embedded finance capabilities

AI and innovation ready

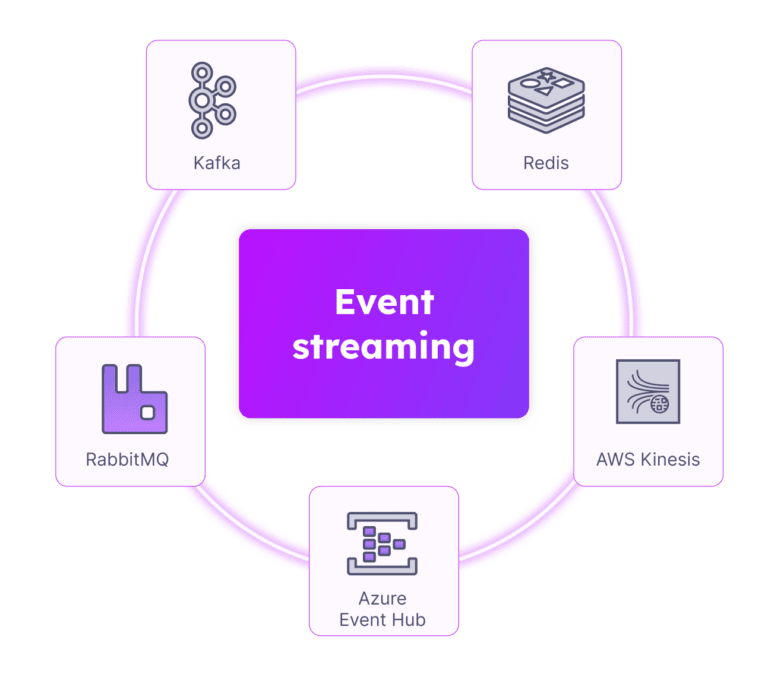

- Event-driven architecture support (Kafka, streaming)

- Real-time data APIs for ML models

- GraphQL for flexible data queries

- Low latency for AI decision engines

- Microservices-native platform

Security you can trust

Technical excellence meets business agility

Discover enterprise-grade security at startup speed. Tyk is ISO 27001, ISO 9001, and SOC2 certified, and deployed in PCI-compliant environments around the globe. With trusted security in place, you can focus on scaling and innovating.

Enterprise-grade security

· FAPI 2.0 security profiles

· mTLS, JWT validation, token binding

· Comprehensive audit trails for regulatory compliance

· Real-time threat detection integration (Wallarm, etc.)

Simplified GraphQL API management

· Sub-50ms latency for critical financial APIs

· Proven at 100M+ daily transactions

· Kubernetes-native, cloud-ready architecture

· Global distributed deployments

· 99.99% uptime SLA

Operational resilience

· Multi-cloud, hybrid, on-premise

· Mainframe to Kubernetes support

· Container-native with Helm charts

· GitOps-ready with Tyk Operator

· Regional data sovereignty compliance

Achieve more, faster

Connect everything, integrate anywhere

Tyk works with your existing technology investments, flexing to meet your needs instead of locking you into a set way of working. We’re about performance and agility, not complexity and constraints.

Leave legacy limitations behind

Still running your APIs on a platform designed long before cloud-native architecture? There is an alternative…

Tyk helps you modernize without compromise, maintaining FAPI compliance and preserving your Open Banking certifications throughout the transition. With Tyk, you can migrate in phases to minimize risk while adopting modern CI/CD workflows, cloud-native flexibility, and a future-ready API management platform.

Mulesoft ESB

→ Tyk

Achieve cost savings of up to 70% when moving to Tyk’s cloud-native architecture and financial services API management.

IBM DataPower

→ Tyk

Discover simplified operations, how to connect to fintech partners seamlessly, and Tyk’s developer-friendly environment.

CA Layer7

→ Tyk

Harness the power of modern DevOps workflows and container support.

Custom API layers

→ Tyk

Eliminate your maintenance burden and gain enterprise features with Tyk’s modern API platform for financial services.

Start for free

Get a demo

Transform your financial services API strategy

Whether you’re building an Open Finance platform, scaling fintech partnerships, or preparing for AI-driven banking, Tyk gives you the secure, flexible foundation to innovate at speed and deliver better digital experiences.